Tax function charges to clearly separate the customer should pay taxes, the hotel fee displays details on the bill of payments.

Bookings made after configuration will be charged the default tax charge

Only the ownwer, the manager hotel can do this.

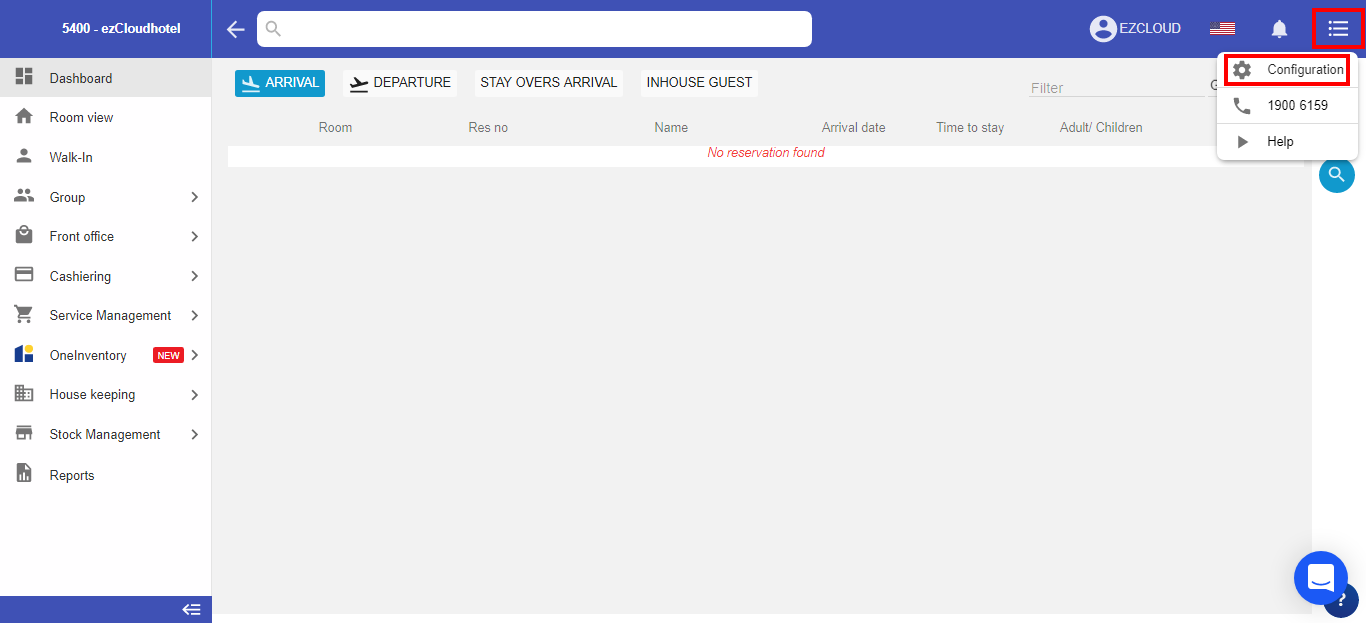

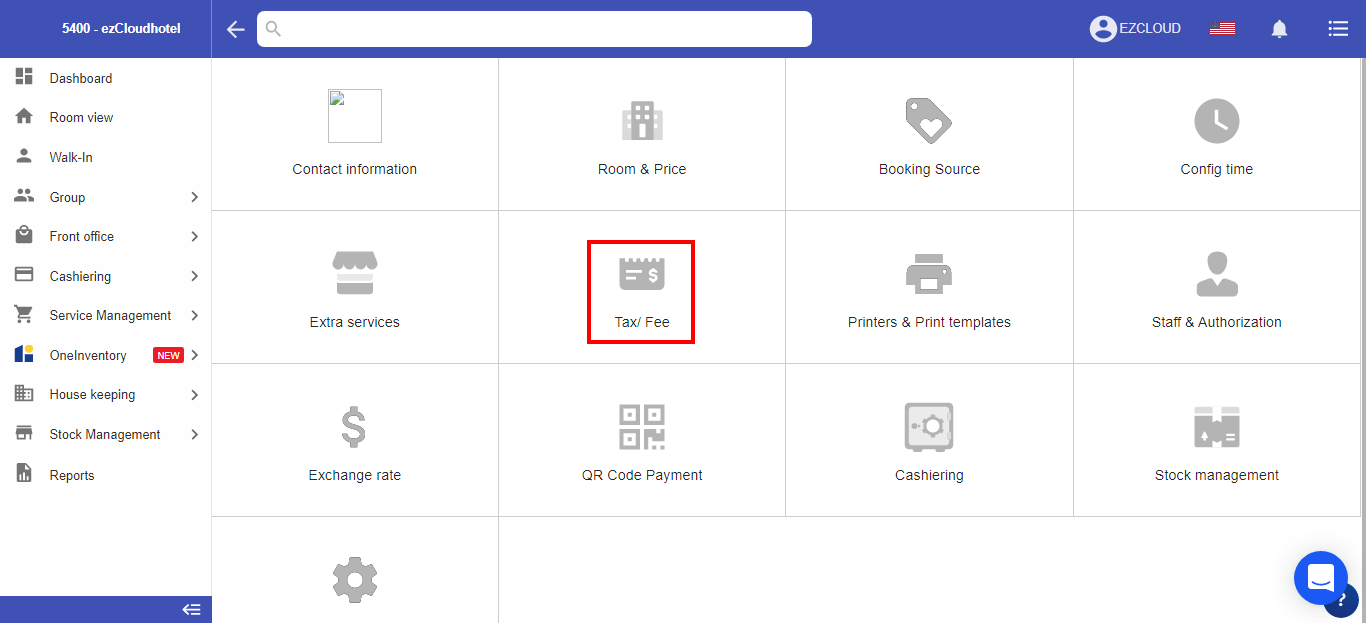

Select the 3-tile ![]() > Select configuation > Select Tax/Fee

> Select configuation > Select Tax/Fee

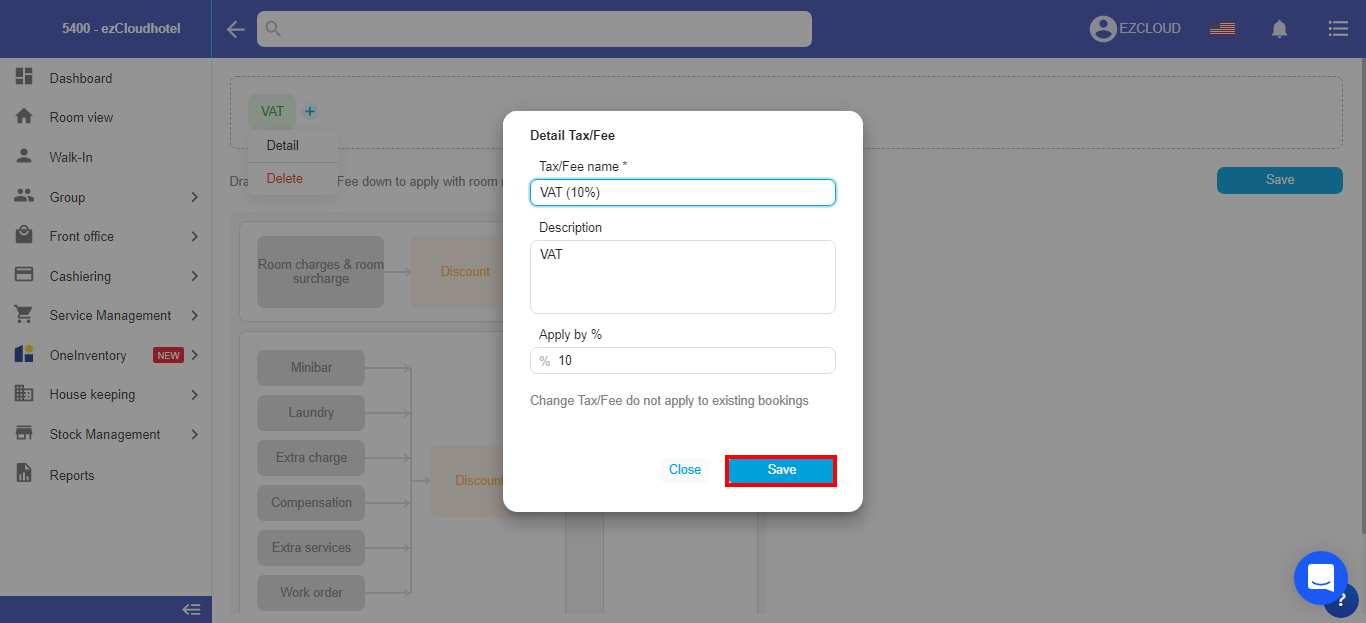

The software displays a pop-up tax/fee, the hotel needs to fill the following information ( tax/fees changes without applicate for bookings in use)

+Tax/fee name: Will be displayed on the invoice for guests.

+ Description: Will be displayed at the bottom invoice

+ Apply by %

After then select Save

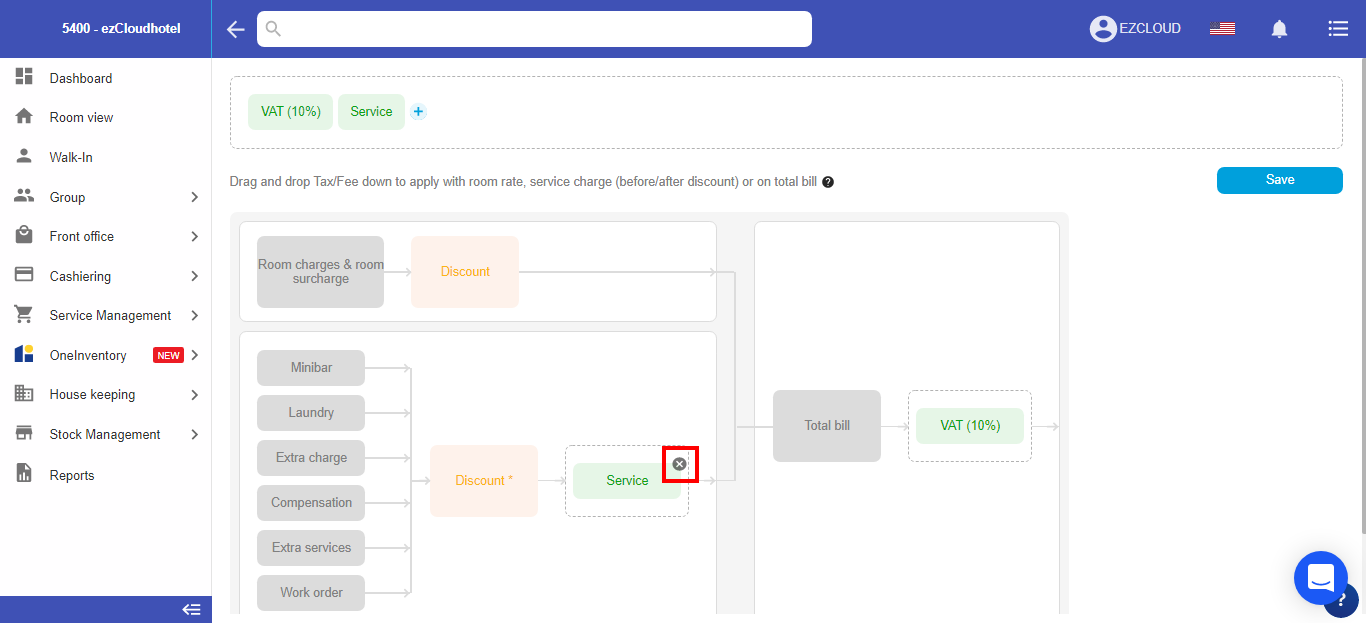

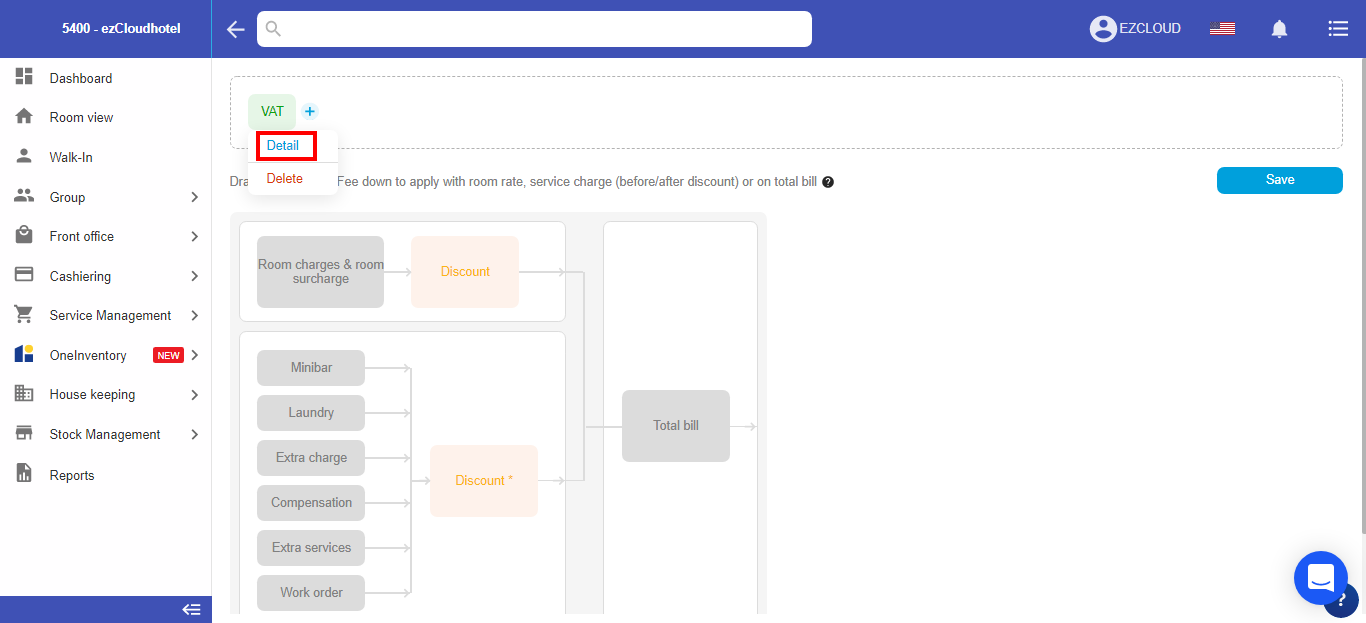

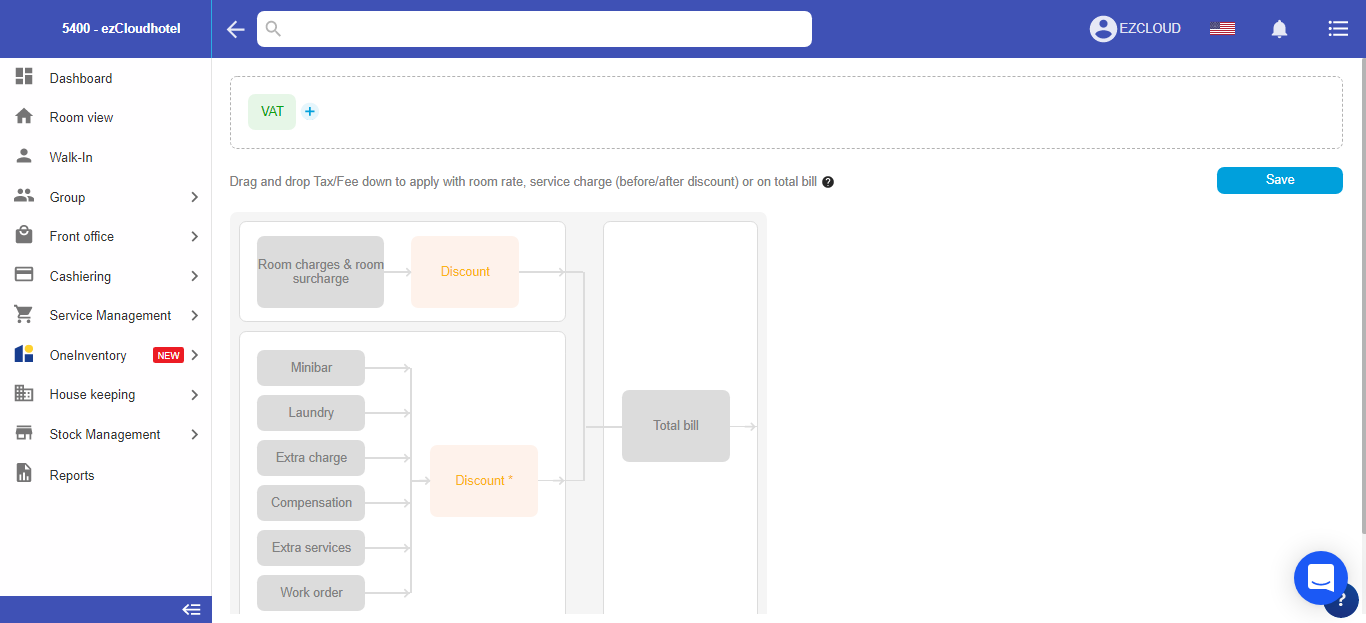

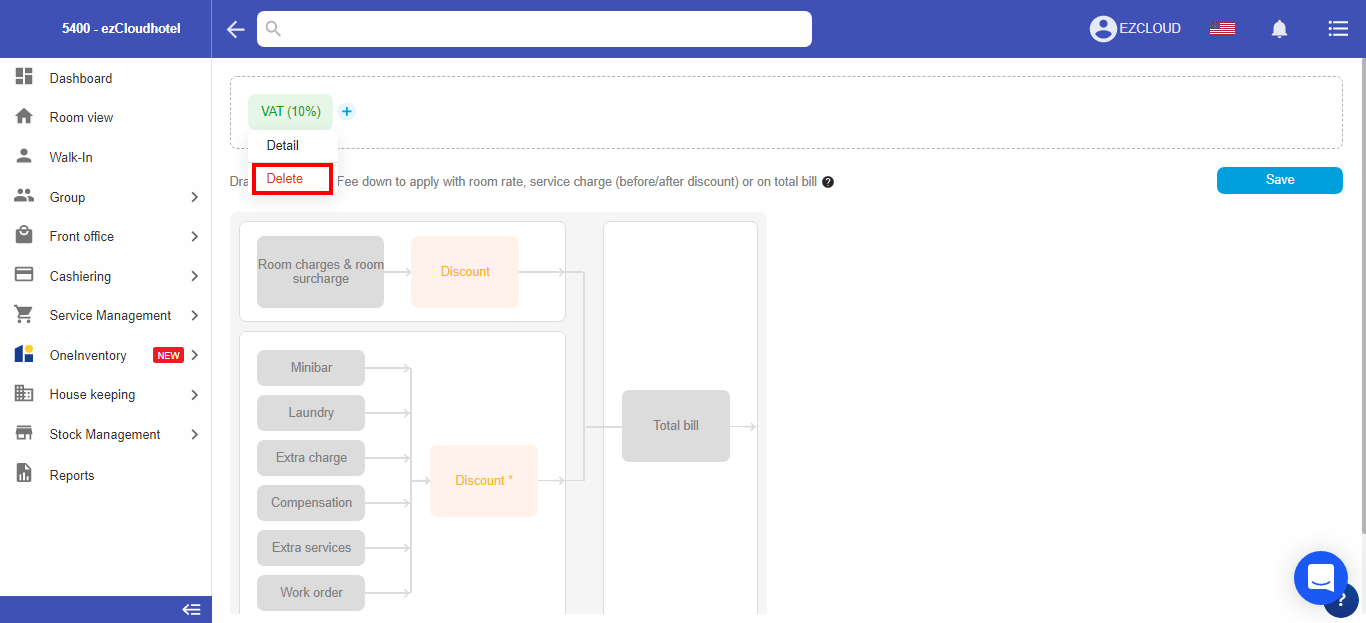

After then to add the type of taxes/fees, the software display like that:

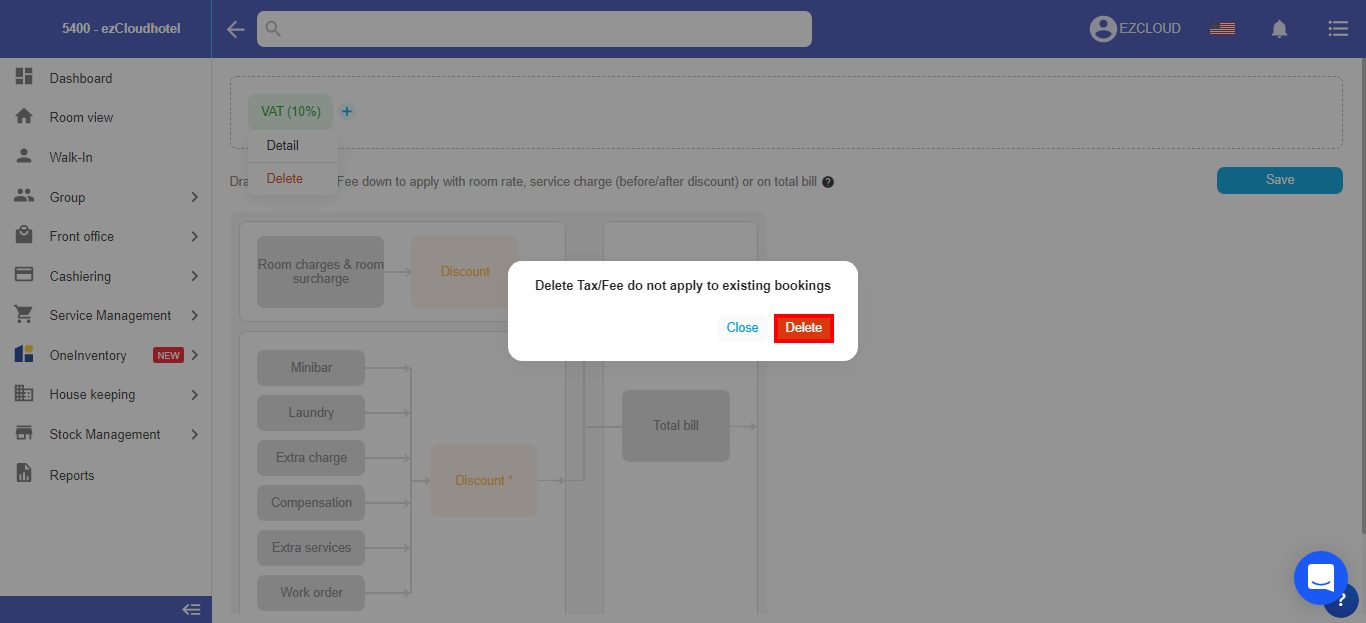

The software displays a pop-up tax/fee, The hotel to fill the information to change > select Save (This change without affected by previously applied bookings)

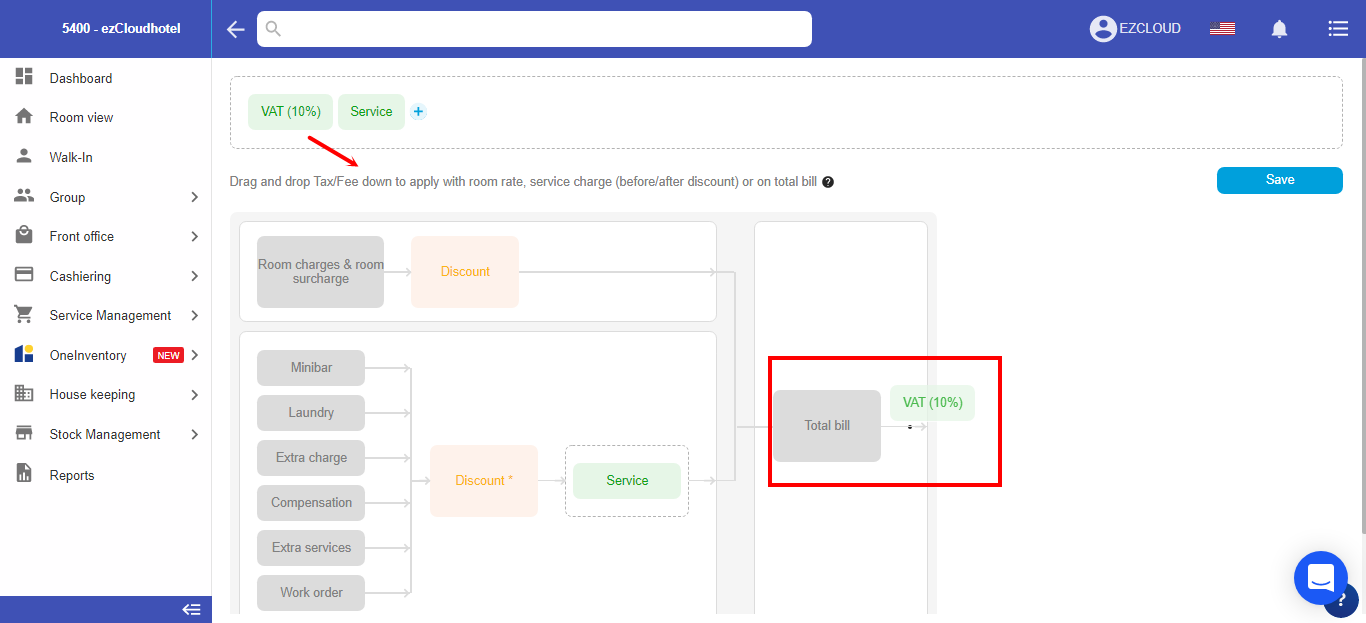

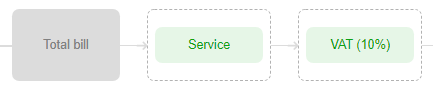

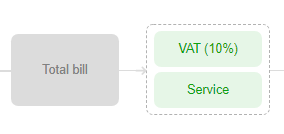

Hotels hold the mouse, drag and drop taxes/fees down the diagram to apply for room, fee service (before/after discount) or on the total bill then seclect Save

The taxes/fees counting after fee service

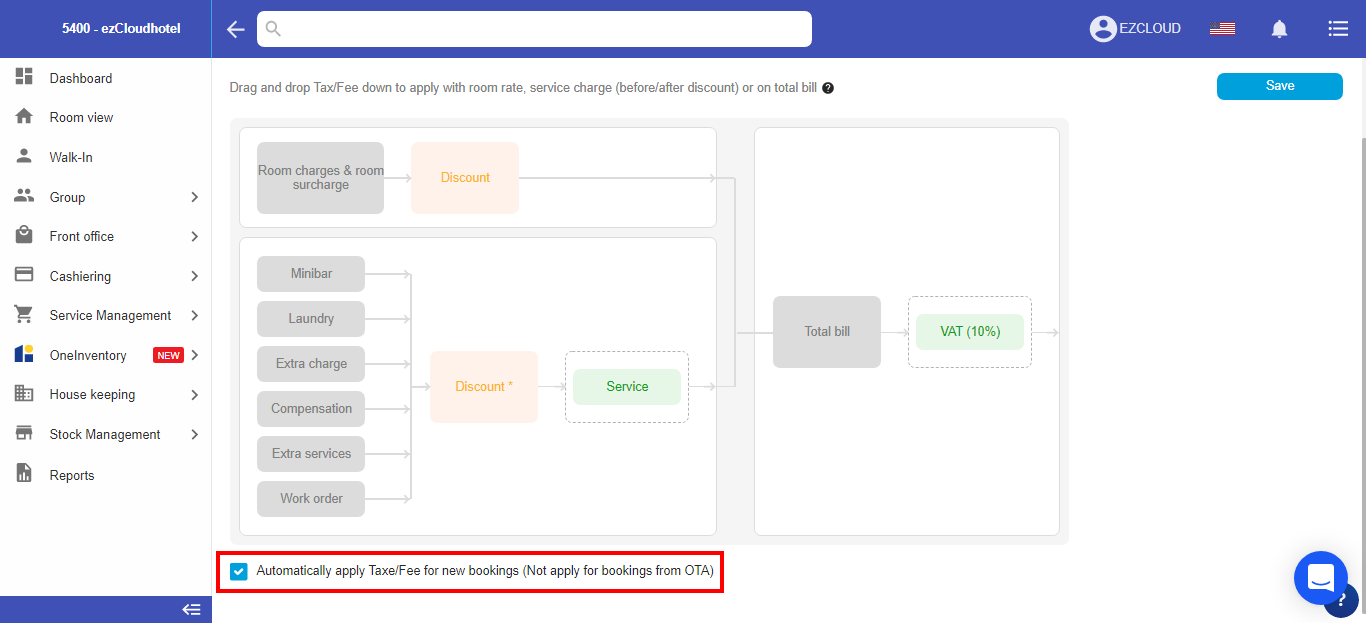

Note: Automatically apply taxes/fees on new bookings (not applicable for automatic bookings from ezCMS, ezBE, One Inventory)

Tick to apply automatically, skip to the manual entry for each booking